TLDR

- CoreWeave exceeded Q1 revenue expectations, reporting $981.6M versus analyst estimates of $862.3M

- The company announced plans to spend $20-23B in 2025, outpacing Wall Street’s forecast of $18.3B

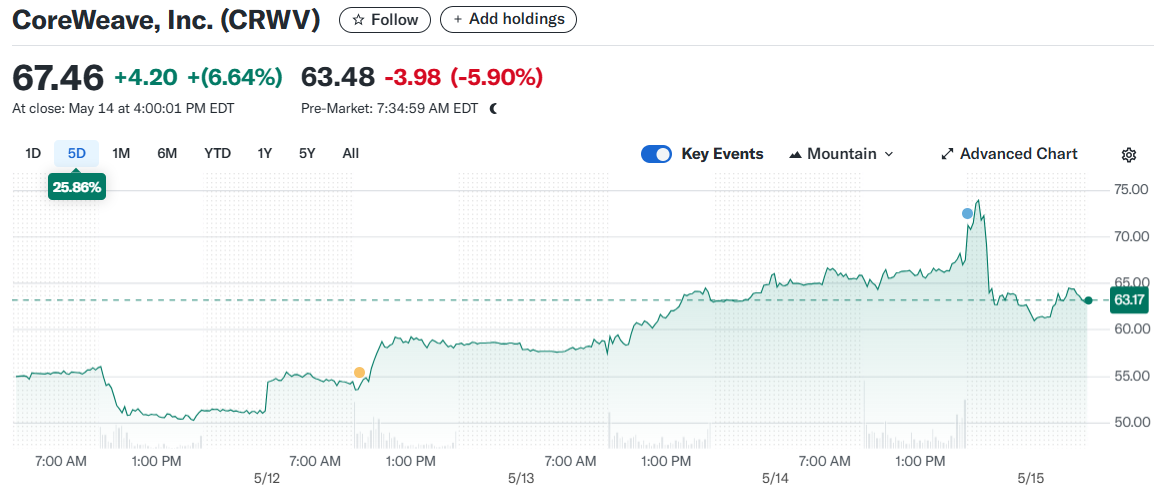

- Stock whipsawed: rose 11% after earnings release before dropping 8% in premarket trading

- A new $4B deal with an unnamed “large AI enterprise” was announced alongside OpenAI partnership

- Despite revenue growth, CoreWeave posted a larger-than-expected Q1 net loss of $150M

CoreWeave’s first quarterly earnings report as a public company sent its stock on a wild ride this week. The Nvidia-backed AI infrastructure provider saw its shares initially jump after reporting strong revenue, only to slide in premarket trading as investors processed its aggressive spending plans.

The company posted first-quarter revenue of $981.6 million, handily beating analyst projections of $862.3 million. Management’s outlook was equally upbeat, forecasting Q2 revenue between $1.06 billion and $1.1 billion, with full-year expectations of $4.9 billion to $5.1 billion.

These projections outpace Wall Street’s estimates of $1.04 billion for Q2 and $4.6 billion for 2025. The rosy outlook stems from a deal with OpenAI and a freshly announced $4 billion agreement with what CEO Michael Intrator described as a “large AI enterprise” hyperscaler.

The strong revenue story wasn’t enough to overcome investor concerns about spending, however. CoreWeave executives revealed plans to spend between $20 billion and $23 billion in 2025, well above the $18.3 billion analysts had anticipated.

“The higher spending is fundamentally driven by increased customer demand,” explained CFO Nitin Agrawal during the earnings call.

Betting Big on AI Growth

CoreWeave sits at the center of the AI infrastructure gold rush. The company owns and operates one of the largest collections of Nvidia GPUs, which it rents to tech giants like Microsoft and Meta as they race to build AI capabilities.

This prime position in the AI ecosystem has fueled CoreWeave’s explosive growth. Year-over-year revenue increased by a staggering 420% according to Citi analyst Tyler Radke.

But this growth comes at a steep price. The company’s capital structure relies heavily on debt, with roughly $12 billion in commitments carrying interest rates between 10% and 14%, according to DA Davidson analyst Gil Luria.

CoreWeave uses these funds to purchase more Nvidia chips, using existing GPUs as collateral. It’s a high-stakes strategy that works as long as demand remains strong.

“The risk is this is a company that is borrowing at extraordinarily high interest rates to buy a product that depreciates very rapidly in terms of its economic value,” Luria told Yahoo Finance.

Profitability Remains Elusive

Behind the impressive revenue numbers lies a company still searching for profitability. CoreWeave reported an adjusted net loss of approximately $150 million for Q1, much worse than the expected $41.7 million loss.

Citi’s Radke pointed out several financial metrics that missed expectations. Adjusted EBIT margins came in below forecasts, while earnings per share and net income fell short due to higher interest expenses.

The company’s Q1 capital expenditures of $1.9 billion also missed the anticipated $2.6 billion mark. This lower-than-expected spending in Q1 makes the projection of $20-23 billion for the full year 2025 even more striking.

Customer Concentration Risks

Another red flag for analysts is CoreWeave’s reliance on a small number of large customers. Regulatory filings show that 77% of the company’s 2024 revenue came from just two clients, with Microsoft accounting for 62%.

CoreWeave stated that no customer made up more than 50% of its Q1 revenue but acknowledged this would change with its new $4 billion deal. This dependence on a handful of tech giants creates vulnerability should any of these relationships change.

“As long as demand for AI services continues to grow exponentially, they’ll be fine,” Luria noted. But if demand cools, “this doesn’t go well because this is a company with inherently low margins and low returns that is borrowing at very high rates.”

Financial Maneuvering

To support its ambitious growth plans, CoreWeave has been actively strengthening its financial position. The company recently expanded its revolving credit facility from $650 million to $1.5 billion and extended its maturity to May 2028.

Reports also indicate that CoreWeave is in talks to raise approximately $1.5 billion through high-yield bonds, with JPMorgan Chase potentially leading the effort. These moves come after the company scaled back its IPO from a planned $4 billion to $1.5 billion due to market conditions.

Split Analyst Views

Wall Street remains divided on CoreWeave’s prospects. Seven analysts tracked by Bloomberg maintain Buy ratings on the stock, while nine hold Neutral ratings. Hedgeye Risk Management has taken a short position.

Northland recently initiated coverage with an Outperform rating and an $80 price target. The firm projects a 31% long-term free cash flow margin and expects CoreWeave to capture 10% of the AI infrastructure-as-a-service market by 2025.

Macquarie takes a more cautious stance with a Neutral rating and $56 target. Their analysis highlights CoreWeave’s proprietary Cloud Platform as a key differentiator but stops short of a Buy recommendation.

Citi’s Radke maintained a Neutral rating with a $43 price target despite the revenue beat, suggesting the recent stock price increase combined with potential downward revisions to bottom-line forecasts could lead to near-term pressure on the shares.