TLDR

- Bitcoin hits a new high above $110K as realized cap jumps $3B

- Major firms like BlackRock increasing exposure showing rising institutional demand

- Analyst points to $125K–$150K targets as momentum builds for a potential August rally

Bitcoin (BTC) has once again made history, breaking past the $110,000 mark on May 21 and setting a new all-time high as investor confidence and institutional interest push the asset to record levels.

Bitcoin Breaks $110K Barrier

The latest milestone comes alongside a $3 billion surge in Bitcoin’s realized capitalization, a key on-chain metric that analysts interpret as a signal of sustained market accumulation.

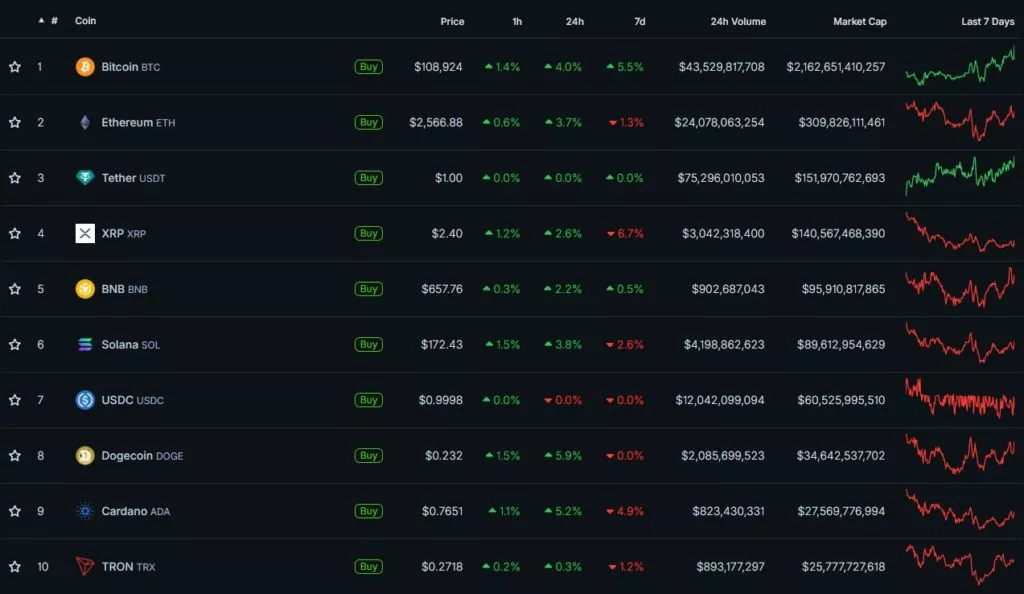

According to data from CoinGecko, Bitcoin’s average exchange-weighted price surged to $108,924, peaking just above $110,000 during U.S. evening trading hours Wednesday. This surpasses its previous all-time high of $109,312 recorded on January 20. The rally contributed to an overall crypto market cap of $3.54 trillion, with Bitcoin’s dominance climbing above 61%.

On-Chain Data Signals Accumulation

Meanwhile, on-chain analytics firm CryptoQuant highlighted the sharp increase in Bitcoin’s realized capitalization as a strong bullish indicator. Realized cap, which reflects the total value of Bitcoin based on the price at which each coin last moved, is seen as a proxy for market conviction. When this metric rises sharply, it suggests that investors are buying at higher prices, thus raising the aggregate cost basis of the network.

“Bitcoin’s Realized Capitalization has increased by over $3.004 billion in just over 24 hours,” noted CryptoQuant analyst Carmelo Aleman. “This represents 0.33% of all capital currently invested in Bitcoin. It not only reflects significant capital inflows, but also confirms a recurring pattern observed since April 11—price impulses followed by lateral consolidation phases.”

Aleman added that the market appears to be entering a new phase of accumulation , likely setting the stage for another bullish move in the next 8–10 days, consistent with recent cyclical behavior.

The bullish sentiment is further reinforced by a sharp uptick in institutional activity. Data shows that BlackRock’s spot Bitcoin ETF, IBIT, recently surpassed $20 billion in holdings. Fidelity and Ark Invest have also reported record inflows, helping position Bitcoin as a core asset in diversified institutional portfolios.

“Markets often move in the opposite direction of retail sentiment and follow the capital flows of institutional whales,” noted analysts from Santiment. “With relatively low levels of FOMO and easing macroeconomic concerns such as U.S.-China tariff tensions, the runway was cleared for Bitcoin to make history.”

Expert Eyes $125K–$150K Targets

That said, veteran trader Peter Brandt, who famously predicted Bitcoin’s 2018 crash, sees more upside ahead. He recently identified a bullish symmetrical triangle and flag pattern on the daily chart, projecting a price target of $125,000 to $150,000 by August 2025.

I think it is wonderful Bitcoin is making ATHs. I am long.

I actually think ATHs is not technically significant

Bull markets make ATHs all the time. It is the definition of a bull market

On track maybe for top of $125,000 to $150,000 by end of August???? (Hey trolls, note the… pic.twitter.com/8PDatXYGP2— Peter Brandt (@PeterLBrandt) May 21, 2025

Elsewhere, popular crypto analyst “Titan of Crypto” reaffirmed a $135,000 target, backed by Fibonacci extension analysis showing the next major resistance near the 161.8% level, aligning with historical bullish market structures.

#Bitcoin $135,000 Target Still in Play for 2025 🚀

The plan is unfolding perfectly.

We kept stacking #BTC when everyone was panicking and got plenty of hate for it.

Imagine still being on the sidelines now… 👀 pic.twitter.com/ry1XeGVsg2

— Titan of Crypto (@Washigorira) May 21, 2025

At press time, BTC was trading at $110,840 reflecting a 2.66% surge in the past 24 hours.