TLDR

- Standard Chartered sees Bitcoin hitting $500,000 by 2029, fueled by rising government investment via Strategy.

- France, Saudi Arabia, and others are gaining BTC exposure indirectly, avoiding regulatory hurdles.

- Growing state and pension fund interest shows Bitcoin is becoming a serious institutional asset.

- Capital shifts, whale buying, and global events are pushing Bitcoin toward long-term growth.

Standard Chartered has reaffirmed its ambitious forecast that Bitcoin could reach $500,000 by 2029, driven in large part by sovereign governments.

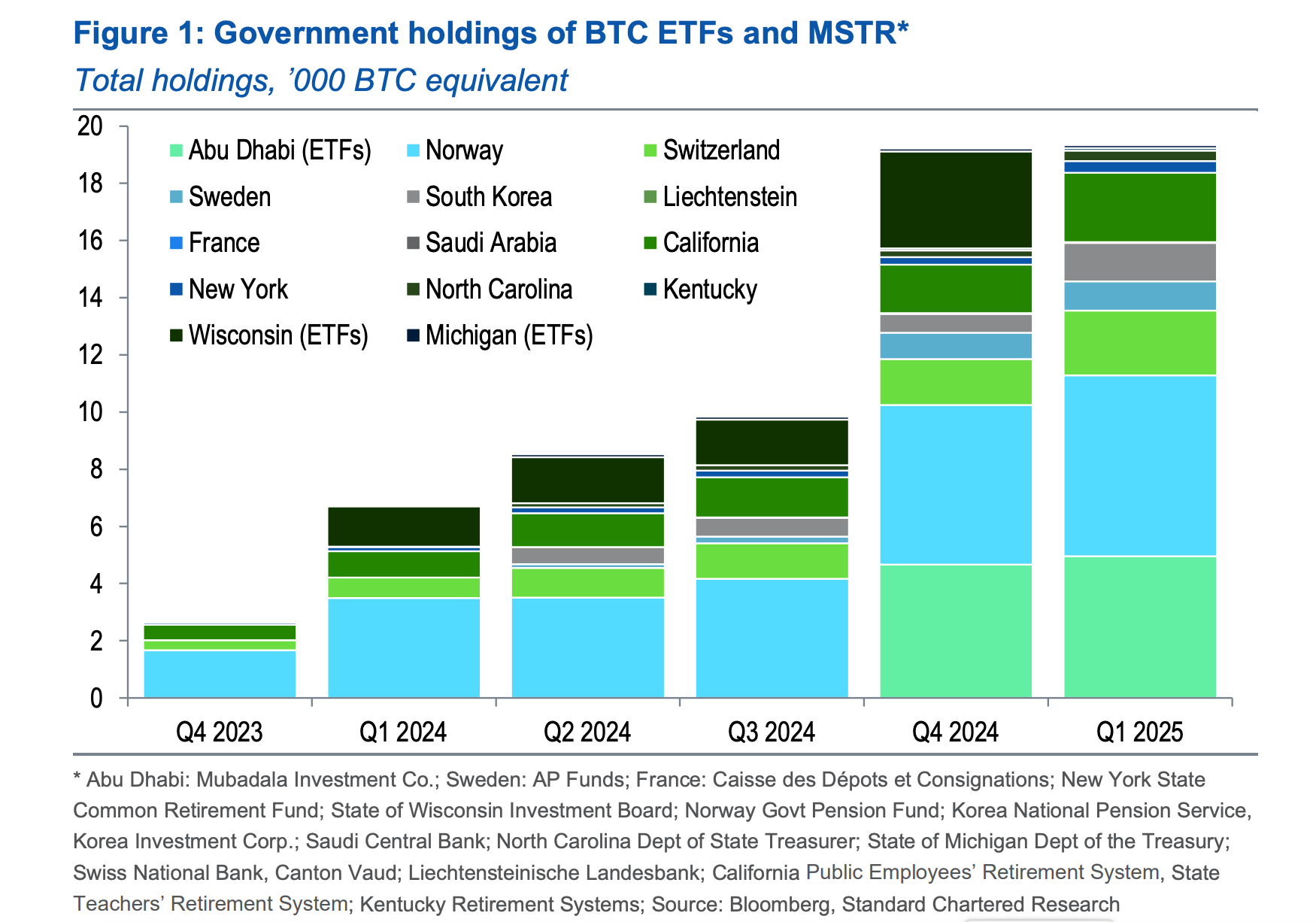

According to the bank, indirect exposure to Bitcoin among government entities has risen sharply in the first quarter of 2025, providing strong backing for its long-term bullish thesis.

In a note this week, Geoffrey Kendrick, Standard Chartered’s global head of digital assets research, pointed to an increase in institutional purchases of Strategy (MSTR) shares as clear evidence of growing sovereign interest. This development, Kendrick argued, supports the bank’s target of Bitcoin hitting half a million dollars before the end of Donald Trump’s term in office.

“Governments appear to be finding creative ways to gain exposure to Bitcoin, particularly in jurisdictions where direct holdings are restricted or heavily regulated,” Kendrick stated.

Indirect Bitcoin Exposure on the Rise

Notably, the catalyst behind Standard Chartered’s claim is the U.S. Securities and Exchange Commission’s (SEC) 13F filings, which reveal quarterly investment data from institutional asset managers. While direct investments in spot Bitcoin ETFs have underwhelmed, holdings in Strategy have surged, indicating a shift toward alternative, yet effective, strategies for Bitcoin exposure.

New entrants in Q1 include France and Saudi Arabia, both of which opened modest but symbolically significant positions in Strategy for the first time. These join existing sovereign investors such as the Norwegian Government Pension Fund, the Swiss National Bank, and several South Korean pension funds, all of which increased their stakes by the equivalent of around 700 BTC each.

U.S. state pension systems have also taken a more active role. Funds from California, New York, North Carolina, and Kentucky collectively added exposure equivalent to 1,000 BTC through MSTR, reflecting a broader trend of state-level Bitcoin interest.

A Shift in Institutional Dynamics

Kendrick further highlighted the significance of these developments in a broader context noting that as more institutions, especially those with conservative mandates like pensions and sovereign funds, allocate to Bitcoin, it confirms that the asset is maturing. It’s no longer a speculative gamble; it’s becoming a strategic allocation.

Interestingly, while Strategy’s purchases surged, some traditional ETF positions saw exits. The Wisconsin Investment Board, for instance, sold its entire position in BlackRock’s IBIT ETF, an equivalent of 3,400 BTC. However, this was partially offset by Abu Dhabi’s Mubadala increasing its stake to 5,000 BTC equivalent.

Kendrick noted that Strategy may be particularly appealing in environments with regulatory constraints.

“In some cases, government institutions prefer MSTR over direct BTC due to legal hurdles or operational limitations around holding digital assets,” he explained.

Macro Forces Aligning

Standard Chartered’s optimism doesn’t rest solely on government interest. Kendrick also cited favorable macroeconomic indicators, including growing capital outflows from traditional U.S. assets and a surge in whale accumulation. These whales, according to the report, have been buying both during recent market dips and rebounds, signaling long-term conviction.

Moreover, recent developments like temporary U.S. tariff suspensions have triggered mass BTC purchases from U.S., Asian and European investors. According to Kendrick, this break in correlation between Bitcoin and tech stocks shows investors are seeking more resilient and globally liquid stores of value.

5/ This quiet support may soon go much louder.

In Jan 2025, the Czech National Bank proposed allocating 5% of its $146B reserves to #Bitcoin.

If passed, that’s $7.3B into BTC, potentially making the Czech Republic the first country in Europe to hold Bitcoin at a national level. pic.twitter.com/esL52cl7Kw

— JAN3 (@JAN3com) May 16, 2025

The Road to $500K

Standard Chartered’s forecast outlines a gradual climb toward $500,000 by the end of the decade. Nearer-term, Kendrick expects Bitcoin to hit $120,000 by Q2 2025, and $200,000 by year’s end, bolstered by ETF inflows, potential stablecoin regulation, and mounting institutional demand.

“We’re watching Bitcoin transition from speculative asset to macro asset,” Kendrick added. “And the growing involvement of governments is the clearest sign yet that this transformation is accelerating.”

At press time, BTC was trading at $106,561, reflecting a 1.30% surge in the past 24 hours