TLDR;

- H100 becomes the first public company in Sweden to buy Bitcoin, acquiring 4.39 BTC.

- The move is part of a long-term plan focused on innovation and financial resilience.

- Other firms doing the same include Metaplanet, Semler Scientific and Altvest Capital.

- Bitcoin to continue soaring as Institutional Investments pour in

Sweden-based tech company H100 has announced the acquisition of 4.39 Bitcoin, officially becoming the first publicly listed institutions in the country to add BTC to its treasury.

First Swedish public company to buy BTC

While the company is not widely known on the global stage like Strategy or Tesla, its announcement on May 22, 2025, that it had acquired 4.39 BTC positioned it within a growing cohort of firms adopting Bitcoin as a balance sheet asset.

H100 described the move as part of a long-term strategy to align with “sovereignty, resilience, and digital-first innovation,” indicating a belief in Bitcoin not just as a financial asset, but as a core part of its corporate philosophy.

We’ve acquired 4.39 BTC — officially becoming Sweden’s first publicly listed Bitcoin Treasury company.

This marks the beginning of a long-term strategy to align our balance sheet with the values of sovereignty, resilience, and digital-first innovation. pic.twitter.com/KPFc0H26uv

— H100 (@H100Group) May 22, 2025

Institutions Continue to Embrace Bitcoin

This development mirrors a growing trend among publicly traded companies around the world that are reallocating portions of their balance sheets into Bitcoin. Japan’s Metaplanet, listed on the Tokyo Stock Exchange, has become one of the most prominent names in this space, with 7,800 BTC currently on its books. Metaplanet began accumulating Bitcoin in April 2024, with the firm framing the move as a strategic response to currency instability and long-term inflationary risks.

Another major player is Semler Scientific, a U.S.-based medical technology company listed on Nasdaq. In a surprising shift for a company outside the tech or crypto sectors, Semler revealed that it had allocated significant capital into Bitcoin, acquiring 581 BTC as part of a new treasury policy. This move represents one of the largest proportional Bitcoin holdings by a non-crypto-focused public firm and reflects a growing cross-industry confidence in the asset.

Earlier this year, Altvest Capital, a South African investment firm, became the first publicly listed company in Africa to adopt Bitcoin as a strategic treasury asset. In February 2025, Altvest announced the purchase of one Bitcoin for approximately 1.8 million rand (around $98,200 USD at the time). The company views Bitcoin as a hedge against currency depreciation and economic instability.

In the Middle East, Phoenix Group from the United Arab Emirates has quietly begun its accumulation strategy, now holding 38 BTC. The move reflects a broader interest among Gulf-based firms in diversifying their reserves with hard digital assets amid global geopolitical and monetary shifts.

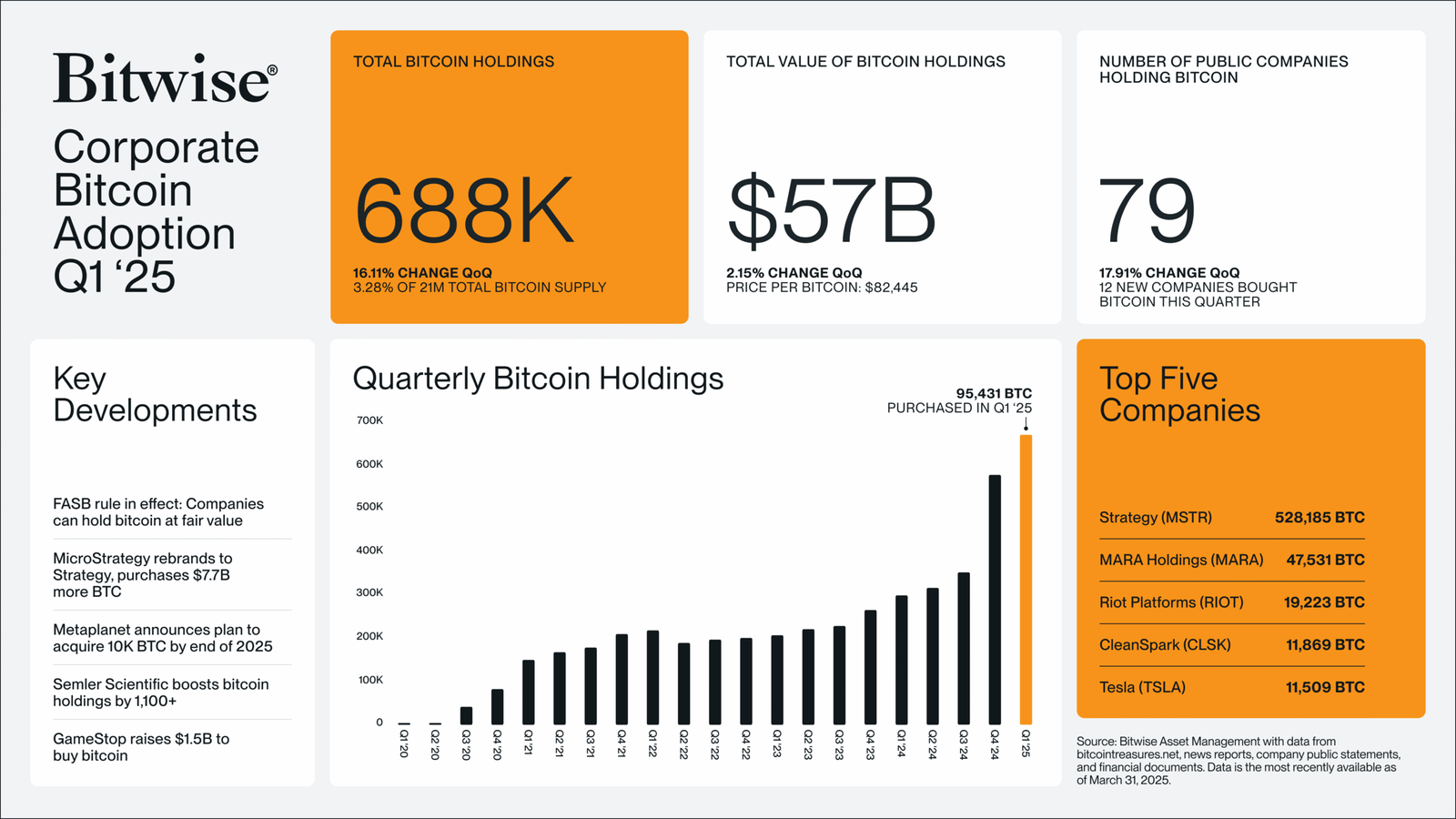

That said, the total amount of Bitcoin held directly by institutions at press time, is estimated to be around 1.8 million BTC, which is roughly 9.5% of all mined Bitcoin. This includes holdings by public companies and investment funds as per a report by Bitwise.

BTC Price About to Explode

Meanwhile analyst Ezy Bitcoin believes Bitcoin could easily soar to $130,000. On Thursday, the pundit highlighted that the market is now perfectly following the Wyckoff Theory after six months of steady accumulation by whales and institutions. This prolonged buildup indicates the current bullish cycle is far from over. According to him, rather than ending soon, the rally could last at least another six months.