TLDR;

-

Strategy has purchased 4,020 more bitcoins for $427.1 million.

-

The company now holds 580,250 BTC, nearly 3% of total supply.

-

This buy was funded by selling stock, including a recent $2.1B raise plan.

-

A class-action lawsuit alleges Strategy misled investors about its Bitcoin strategy.

Strategy, the enterprise software company turned Bitcoin development powerhouse has acquired an additional 4,020 BTC for approximately $427.1 million.

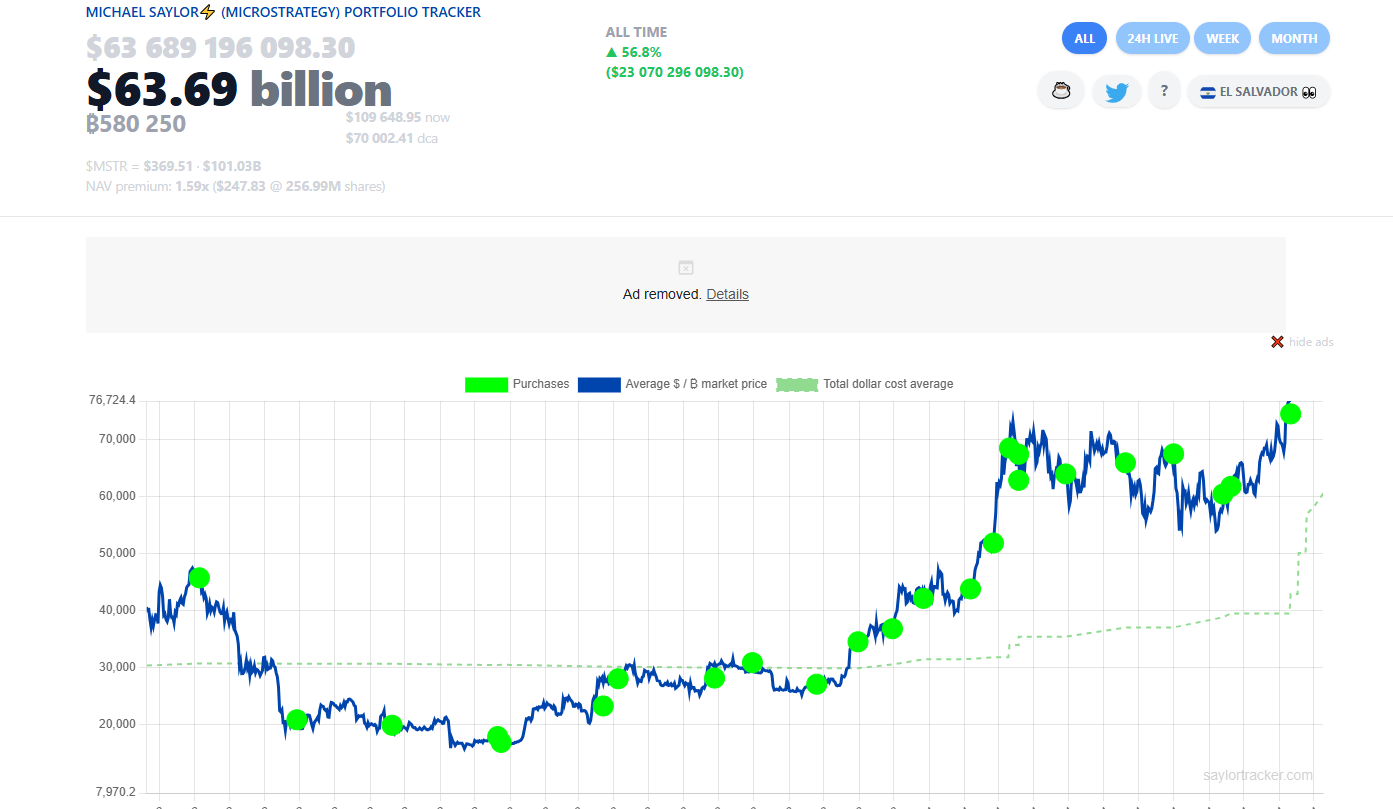

The purchase, made between May 19 and May 25, pushes the firm’s total Bitcoin holdings to a staggering 580,250 BTC.

Strategy has acquired 4,020 BTC for ~$427.1 million at ~$106,237 per bitcoin and has achieved BTC Yield of 16.8% YTD 2025. As of 5/25/2025, we hodl 580,250 $BTC acquired for ~$40.61 billion at ~$69,979 per bitcoin. $MSTR $STRK $STRF https://t.co/eAd03GIKam

— Michael Saylor (@saylor) May 26, 2025

The new acquisition comes just days after Strategy priced a massive preferred stock offering aimed at raising up to $2.1 billion, signaling the company’s unwavering commitment to Bitcoin as its primary treasury reserve asset. The average price paid for the new batch of BTC was around $106,237 per coin.

Nearly 3% of BTC ’s Total Supply

With this latest purchase, Strategy now controls nearly 3% of Bitcoin’s fixed 21 million supply , solidifying its position as the largest corporate holder of the digital asset. At current market prices (around $109,900 per BTC), the company’s Bitcoin stash is valued at over $63 billion.

Notably, since adopting its Bitcoin strategy in August 2020, Strategy , led by Executive Chairman Michael Saylor , has spent a total of $40.61 billion on BTC, averaging a purchase price of roughly $69,800 per coin.

“We view Bitcoin as the most secure and reliable store of value in the modern era,” said Saylor in a recent public statement. “This latest acquisition reaffirms our long-term belief in Bitcoin as a superior alternative to traditional assets.”

That said, the latest purchase comes days after Bitcoin sets a new all-time high, briefly reaching $111,544 on May 22 before recoiling to just over around $109,000 at press time.. Riding the momentum of this rally, Strategy is now holding more than $23 billion in unrealized gains as per data from Saylor Tracker.

Funded Through Stock Sales

According to a regulatory filing with the U.S. Securities and Exchange Commission (SEC), Strategy funded the latest acquisition through a combination of common and preferred stock offerings. Just last week, the company announced a plan to raise up to $2.1 billion by issuing preferred stock, further emphasizing that this accumulation strategy is not slowing down any time soon.

Notably, the company’s aggressive Bitcoin buying comes amid legal turbulence. A class-action lawsuit filed recently by a California-based investor has accused Strategy and its executives of violating federal securities laws. The suit alleges that the firm overstated the expected profitability of its Bitcoin-centric investment model and failed to fully disclose risks to shareholders. In response, Strategy has declared its intention to vigorously defend itself against the charges, arguing that its Bitcoin strategy has always been publicly communicated and rooted in long-term financial conviction.

While the legal battle unfolds, Strategy’s latest Bitcoin buy reinforces its position as the single largest corporate holder of the digital asset. As the firm Strategy keeps deploying capital into Bitcoin, it is influencing a growing list of public companies, such as Metaplanet, Hongk-based DDC, H100 and Semler Scientific and to consider similar approaches.